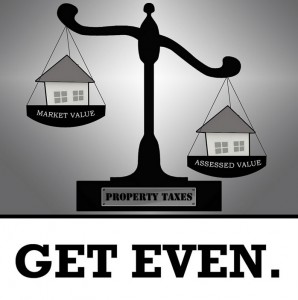

Some of the inquiries I’ve gotten from my Marina Dock Age “Tax appeals may combat the inflated property values of marinas” article have come from persons who have never been involved in a marina tax appeal. Never one to leave a good blog post on the table let me describe the tax appeal process and the various decision points that are encountered.

Some of the inquiries I’ve gotten from my Marina Dock Age “Tax appeals may combat the inflated property values of marinas” article have come from persons who have never been involved in a marina tax appeal. Never one to leave a good blog post on the table let me describe the tax appeal process and the various decision points that are encountered.

The Players

The players in the tax appeal process are itemized below.

- Property Owner (petitioner) – more frequently than not, the person usually who is inexperienced in the tax appeal process

- Assessor – the person who supports the assessment and does not have the burden of proof

- Real Property Tax Consultant – the person who’s next loaf of bread depends on the outcome

- Tax Board Member – usually a citizen and member of the county; sometimes includes an appraiser

- Attorney – the advocate of the property owner

- Appraiser – the hero or the villain depending on how it turns out

Before we start the tax appeal process, one of two things must happen: either the assessment appears high to the property owner or they have been advised that it is by a real property tax consultant or sometimes an attorney.

Filling Out The Appeal Form

The property owner, tax consultant or attorney files the tax appeal form. The form differs from jurisdiction to jurisdiction but most of the items are the same. There are three areas that are found on all forms that are “make or break”:

- The petitioner’s estimate of value

- The justification for the appeal section

- The basis for appeal section

In addition to these three items, there is also one area that is crucial to the petitioner’s estimate of value that is frequently, but not always, found on tax appeal forms: has the property been appraised within one year?

There are several considerations that affect the first “make or break” item, the petitioner’s estimate of value:

- The burden of proof is always on the petitioner, so the level of factual information to be presented and discussed is always greater than what the assessor deals with. In most cases, an appraiser has not been hired at this point, so gathering sufficient evidence and making a strong enough case without him or her is a skill beyond most property owners; this is where the tax consultant comes in. Even then, they can present information and conclusions; however, the Tax Board and the assessor know there is no appraisal on the table and the tax consultant is an advocate of the property owner.

- If an appraiser is hired and the market value is materially higher, the case either dies or in many cases doesn’t justify the expenses necessary to win, especially in State Court. Most tax board members understand that that the appraiser hasn’t been hired and therefore a report has not been prepared prior to filing the appeal, so the petitioner’s estimate of value written on the appeal form has little weight. What it does is open up the possibility that the assessor may want to negotiate a lower assessment prior to the tax board hearing. I say “possibility” because there was a time when that happened on most commercial property tax appeals… but that time has long since come and gone. The property owner would be lucky to get a material reduction before the tax board hearing and prior to submitting an appraisal in today’s economy.

- Sometimes the attorney is hired to complete the estimate of value section on the tax appeal form, but how much do they know about local real estate values and how convincing of a case can they make on the appeal form? Those that make a living from tax appeals are true professionals that command the utmost respect for their knowledge, but those that don’t file tax appeals on a regular basis often don’t know the rules. Determining the familiarity of an attorney with the tax appeal process before hiring them is a question the property owner should to ask as well as the amount of tax board/court litigation experience they posses.

In Part 2, we’ll get into the tax appeal form in more detail.