It’s no secret that we’re starting to see some dark marinas become available for investors. The term “dark” is a real estate term used to describe an empty property. The current news hot button for this word is “shuttered”, although it’s usually applied to a business. Since marinas have a business aspect, I suppose that’s another way to refer to it. A rose is a rose by any other name.

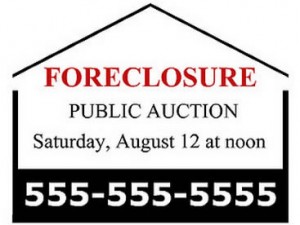

A dark marina occurs when the owner has “handed back the keys” to the lender and defaulted on the loan. The bank then does what they have to do to get the asset off their books. This is typically done by a private sale to an investor. During the Savings and Loan Crisis, the FDIC made these properties available for public auction along with an untold number of other property types. This time around it’s different – the banks themselves are disposing of the asset. Sometimes they even sell the note to marina management firms who are willing to buy it in the hope of repossessing the property should the loan go bad or before the marina owner gets too far behind.

A dark marina occurs when the owner has “handed back the keys” to the lender and defaulted on the loan. The bank then does what they have to do to get the asset off their books. This is typically done by a private sale to an investor. During the Savings and Loan Crisis, the FDIC made these properties available for public auction along with an untold number of other property types. This time around it’s different – the banks themselves are disposing of the asset. Sometimes they even sell the note to marina management firms who are willing to buy it in the hope of repossessing the property should the loan go bad or before the marina owner gets too far behind.

Some of these investors have called our office looking for advice. Some have posted their questions to marina industry people on linkedin. Although I’ve never bought a dark marina, I’ve been a part of many deals having appraised more of these assets for the FDIC during the S&L Crisis than I care to count. For those interested in buying a dark marina, the key question is whether this is a good deal or not. I’ve seen good deals made and I’ve seen bad deals too. I’d like to offer my thoughts for you to consider.

We Always Begin at the Beginning

Before I get into numbers and opinions, there are a couple of things to consider. Buying a marina is like trying on clothing. You’ve got to get the right fit or else you’re going to be uncomfortable. Think of it like this. The last owner couldn’t make a go of it, right? Do you have the knowledge and skill to do better than the last owner? Don’t just blindly say yes to this question… think it through. Can you see something in the property that the last owner who was probably there all the time didn’t? If so, can you whip together a business plan and financial projection that would turn the property around in enough time to realize a profit? Do you have marina management experience and if so, how much?

Leave emotions behind. Just because something is available from a bank doesn’t mean it’s a good deal. Would you spend millions of dollars for bank stocks right now? Now you see my point. ‘Sorry for the introspection… it’s the deal breaker I’ve seen for some marina owners who bought marinas during the S&L crisis and couldn’t turn them around.

The Sands of Time

OK, I know you’re in a rush. You want to close the deal before “someone else does”. As they say… you can’t steal in slow motion. Let’s take a step back though. I’ve been conducting a survey of marina owners for my upcoming Marina Investment book and there is one universal pattern I’ve found that you should know about before you get in too deep. It seems that every marina owner will say that this is a 24/7 type of business. Forget the 40-hour work week. OK, so you’re thinking this applies to everything nowadays, so what’s the big deal? Well, consider this. What’s the peak period of demand for a marina? It’s on the weekend. If your family situation is such that you need to spend time at home on the weekend most weekends out of the peak season, this isn’t the right investment for you. You’re going to get married to the marina so make sure it’s what you and your family want. Marinas are not passive investments.

Now that the Preliminaries Are Out of the Way…

The prelims are done. This is what you want. Now the questions start to morph into what you’re going to do with the marina to turn it around, what type of return on investment are you going to get, how much will it cost to make changes to the facility and the most important question of them all… how can I know this is a good deal? I’d say those are good reasons to visit the next part of this blog series.