The second major "make or break" section of the tax appeal form, the justification for the appeal, is where the petitioner typically makes a reference to exhibits and a detailed synopsis of the key points that warrant an assessment reduction. This affects others involved with the case as follows:

Read more- The attorney knows the nuances of.

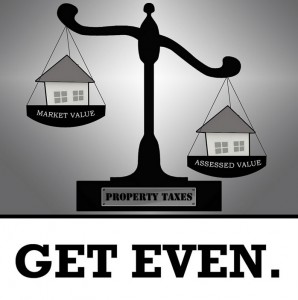

Some of the inquiries I've gotten from my Marina Dock Age "Tax appeals may combat the inflated property values of marinas" article have come from persons who have never been involved in a marina tax appeal. Never one to leave a good blog post on the.

Some of the inquiries I've gotten from my Marina Dock Age "Tax appeals may combat the inflated property values of marinas" article have come from persons who have never been involved in a marina tax appeal. Never one to leave a good blog post on the.